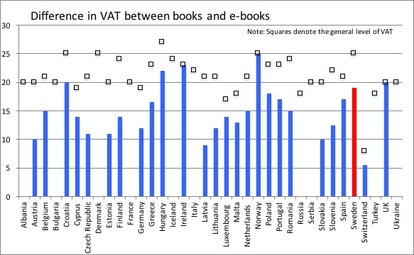

In most instances regulatory obstacles and hurdles are not black or white, there is usually some argument that supports even strange rules. When it comes to VAT differences between print and e-books, however, it is exceedingly hard to find even the faintest rationale. Reading a book or an e-book are arguably just different ways to consume the same good. For countries in Europe, the figure below shows the differences in VAT on books and e-books in the vertical bars, along with the general level of VAT. Overall, the price difference is quite significant in Europe. Although only a few countries have no differences and a fairly low applicable VAT, such as France, Iceland, and Italy, most other countries have considerable differences. Ireland has one of the largest discrepancies at 23 percentage points, with zero VAT on print books but 23 percent on e-books; Denmark has the same VAT for both media, but at the high rate of 25 percent. The median difference in VAT is just over 12 percentage points. In Sweden, the difference is 19 percentage points. For the 79 countries covered in the survey, 35 apply a higher rate of VAT to e-books than to print books. Note: The bars show the difference between VAT on print books compared to e-books. Some countries have no difference (and hence the bar is at zero, in Italy, for example). The square indicates the general VAT level in that country. Source: International Publishers Association (2015). “VAT/GST on Books & E-books.” An IPA/FEP Global Special Report. July 2015.

1 Comment

|

Mårten BlixI will write comments on digitalization and other other economic issues here Archives

March 2017

Categories |

Copyright Mårten Blix 2023

RSS Feed

RSS Feed